Exploring the importance of reviewing your life insurance quote annually can lead to valuable insights and benefits. By understanding the impact of life changes on your insurance needs and ensuring adequate coverage for your loved ones, you can make informed decisions for the future.

Importance of Regularly Reviewing Life Insurance Quotes

Regularly reviewing your life insurance quotes is crucial to ensure that you have adequate coverage for your needs and those of your beneficiaries. By taking the time to review your policy annually, you can make sure that you are prepared for any changes in your life circumstances that may affect your insurance requirements.

Benefits of Reviewing Life Insurance Quotes Annually

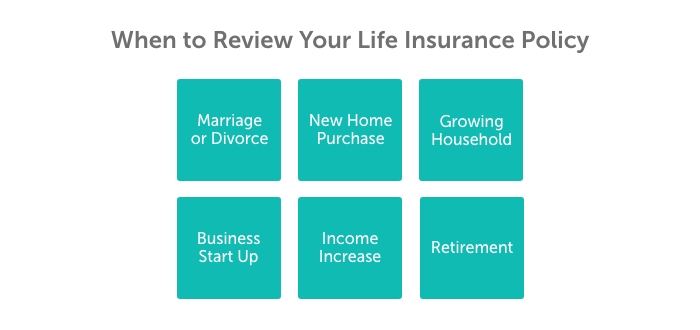

- Identify Changes: Reviewing your life insurance quote annually allows you to identify any changes in your life circumstances, such as getting married, having children, or buying a new home. These changes may impact the amount of coverage you need to adequately protect your loved ones.

- Adjust Coverage: By reviewing your life insurance quotes regularly, you can adjust your coverage to align with your current needs. This ensures that your beneficiaries will receive the financial support they need in the event of your passing.

- Save Money: Regularly reviewing your life insurance quotes can also help you identify opportunities to save money. You may find that you are eligible for discounts or that there are more cost-effective policies available that still provide the coverage you need.

Ensuring Adequate Coverage for Your Beneficiaries

- Protecting Loved Ones: By reviewing your life insurance quote annually, you can ensure that your beneficiaries will be financially protected in the event of your passing. This peace of mind is invaluable and can provide reassurance to your loved ones during a difficult time.

- Planning for the Future: Life insurance is a crucial part of planning for the future and ensuring that your loved ones are taken care of. By regularly reviewing your quotes, you can make sure that your coverage aligns with your current needs and future goals.

Factors to Consider When Reviewing Life Insurance Quotes

When reviewing life insurance quotes, it's essential to pay attention to certain key factors that can significantly impact your coverage and premiums. Changes in your health, lifestyle, inflation, and market conditions can all play a role in determining the suitability of your life insurance policy.

Key Elements to Look for in a Life Insurance Quote

- Coverage Amount: Ensure that the coverage amount aligns with your current financial obligations and future needs.

- Premiums: Compare premium rates from different insurers to find the most cost-effective option.

- Policy Terms: Understand the terms and conditions of the policy, including exclusions and limitations.

- Riders: Check for optional riders that can enhance your coverage, such as critical illness or disability benefits.

How Changes in Your Health or Lifestyle Can Impact Insurance Premiums

Changes in your health or lifestyle, such as quitting smoking, losing weight, or managing existing health conditions, can lead to lower insurance premiums. Insurers often adjust premiums based on your current health status and lifestyle choices. Regularly reviewing your life insurance quote allows you to update any positive changes and potentially reduce your premiums.

How Inflation and Market Conditions May Influence Policy Coverage

Inflation and market conditions can impact the purchasing power of your life insurance coverage over time. It's essential to review your policy regularly to ensure that the coverage amount is sufficient to meet your financial needs in the future. Adjusting your policy to account for inflation or changing market conditions can help maintain the value of your insurance coverage.

Comparison of Different Insurance Quotes

When reviewing life insurance quotes, it is crucial to compare offerings from different insurance providers to ensure you are getting the best coverage for your needs. Here are some steps on how to effectively compare quotes and make an informed decision.

Comparing Coverage, Premiums, and Benefits

- Examine the coverage amount: Make sure the coverage offered by each provider aligns with your financial obligations and future needs.

- Compare premiums: Look at the cost of the premiums for each policy and consider how they fit into your budget.

- Evaluate benefits: Check the additional benefits offered by each policy, such as riders for critical illness or disability coverage.

Evaluating Reputation and Financial Stability

- Research the reputation: Look up reviews and ratings of each insurance company to gauge customer satisfaction and service quality.

- Check financial stability: Review the financial strength ratings of insurers from agencies like AM Best or Standard & Poor's to ensure they can fulfill their obligations.

- Consider company history: Look into the longevity and track record of each insurance provider to assess their reliability over time.

Benefits of Working with an Insurance Agent

When it comes to navigating the world of life insurance, working with an insurance agent can offer numerous advantages. These professionals have the knowledge and expertise to guide you through the complexities of insurance policies, ensuring you make informed decisions that align with your needs and goals.

Advantages of Seeking Assistance from an Insurance Agent

- Personalized Guidance: An insurance agent can provide personalized guidance based on your individual circumstances, helping you choose the most suitable life insurance policy.

- Expert Advice: Agents are well-versed in insurance terminology and can explain complex terms and options in a way that is easy to understand, empowering you to make informed choices.

- Access to Multiple Options: Agents work with multiple insurance providers, giving you access to a range of policies and quotes to compare and choose from.

Role of an Agent in Finding the Most Suitable Policy

- Assessment of Needs: Agents assess your specific needs and financial situation to recommend a life insurance policy that provides adequate coverage.

- Policy Customization: Agents can help tailor a policy to meet your requirements, ensuring you have the right amount of coverage for your family's financial security.

- Continuous Support: Insurance agents provide ongoing support, assisting you in reviewing and updating your policy as your circumstances change over time.

Last Recap

In conclusion, regularly reviewing your life insurance quote is a crucial step in ensuring your financial security and protecting your family. By staying informed about changes in coverage, premiums, and benefits, you can make adjustments that align with your evolving needs.

Q&A

Why should I review my life insurance quote every year?

Reviewing your life insurance quote annually helps you stay updated on any changes in coverage, premiums, and benefits to ensure your policy aligns with your current needs.

How do changes in my life circumstances affect my insurance needs?

Life changes such as marriage, having children, or buying a home can impact your insurance needs, making it essential to review your policy regularly.

What factors should I consider when comparing insurance quotes?

When comparing insurance quotes, consider coverage, premiums, benefits, reputation of insurance companies, and your specific needs to make an informed decision.

Why is working with an insurance agent beneficial?

An insurance agent can help you navigate complex insurance terms, understand your options, and find the most suitable life insurance policy tailored to your requirements.