What Factors Affect Your Life Insurance Quote the Most? sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

Exploring the key elements that heavily influence your life insurance quote can provide valuable insights into securing the best coverage for your needs. From age and health conditions to lifestyle choices and occupation, each factor plays a significant role in determining your life insurance premiums.

Let's delve into these factors to understand how they impact your insurance costs.

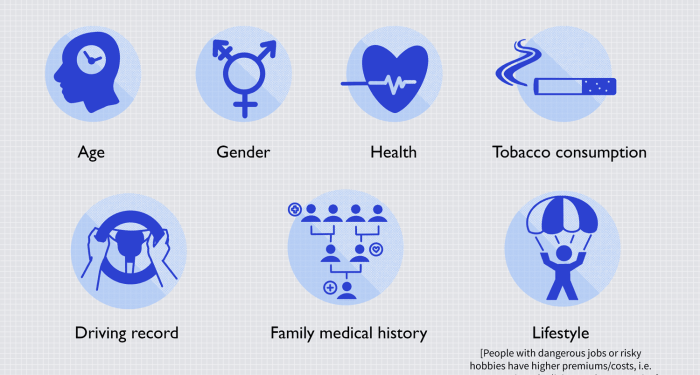

Factors Affecting Life Insurance Quotes

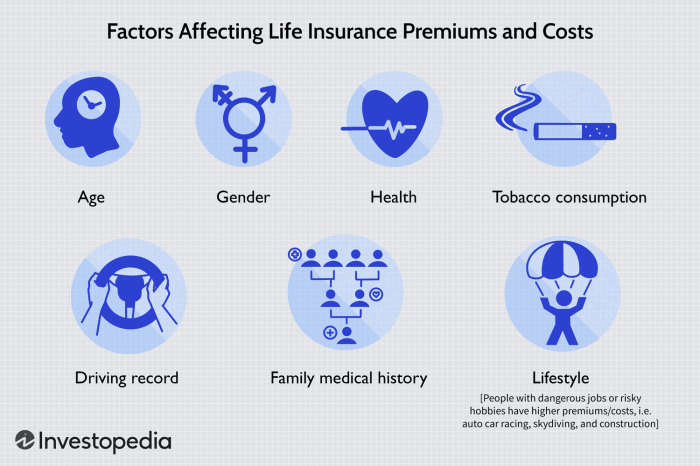

When applying for life insurance, various factors can significantly impact the quotes you receive. These factors include age, health conditions, lifestyle choices, and occupation. Understanding how each of these elements influences your life insurance rates can help you make informed decisions when selecting a policy.

Age

As one of the most significant factors affecting life insurance quotes, age plays a crucial role in determining the cost of your policy. Generally, younger individuals are considered lower risk by insurance companies, resulting in lower premiums. As you age, the risk of developing health issues increases, leading to higher insurance rates.

Health Conditions

Your current health status is another key determinant of life insurance premiums. Individuals with pre-existing health conditions may face higher rates due to the increased risk of potential claims. Insurance companies typically assess your overall health, including medical history, lifestyle habits, and family health history, to determine the level of risk you pose.

Lifestyle Choices

Certain lifestyle choices, such as smoking, excessive drinking, or engaging in high-risk activities, can raise your life insurance rates. Insurers view these habits as increasing the likelihood of premature death, resulting in higher premiums. Maintaining a healthy lifestyle, including regular exercise and a balanced diet, can help lower insurance costs.

Occupation

Your occupation can also impact your life insurance costs. Individuals in high-risk professions, such as firefighters, pilots, or deep-sea divers, may face higher premiums due to the increased likelihood of work-related accidents or health issues. Insurance companies assess the occupational hazards associated with your job to determine the level of risk involved.

Importance of Coverage Amount

Choosing the right coverage amount is crucial when it comes to determining your life insurance quote. The coverage amount you select will directly impact the premiums you pay and the benefits your loved ones receive in the event of your passing.

Difference in Premiums for Term Life Insurance vs. Whole Life Insurance

- Term life insurance typically offers lower premiums compared to whole life insurance because it provides coverage for a specific term, without any cash value accumulation.

- Whole life insurance, on the other hand, is more expensive but offers lifelong coverage and a cash value component that grows over time.

- When comparing quotes, the coverage amount will affect premiums differently for term and whole life insurance policies.

Impact of Adding Riders to a Life Insurance Policy

- Adding riders to a life insurance policy can increase the coverage amount and customize your policy to better suit your needs.

- While adding riders may enhance your coverage, it can also raise your premiums, depending on the type of rider and the extent of coverage it provides.

- Be sure to carefully assess the impact of adding riders on your life insurance quote before making a decision.

Length of the Policy Term

- The length of the policy term, whether it's 10, 20, or 30 years, can significantly impact your life insurance costs.

- Shorter policy terms typically have lower premiums, but the coverage period is limited.

- Longer policy terms may have higher premiums but offer coverage for an extended period, providing more financial protection to your beneficiaries.

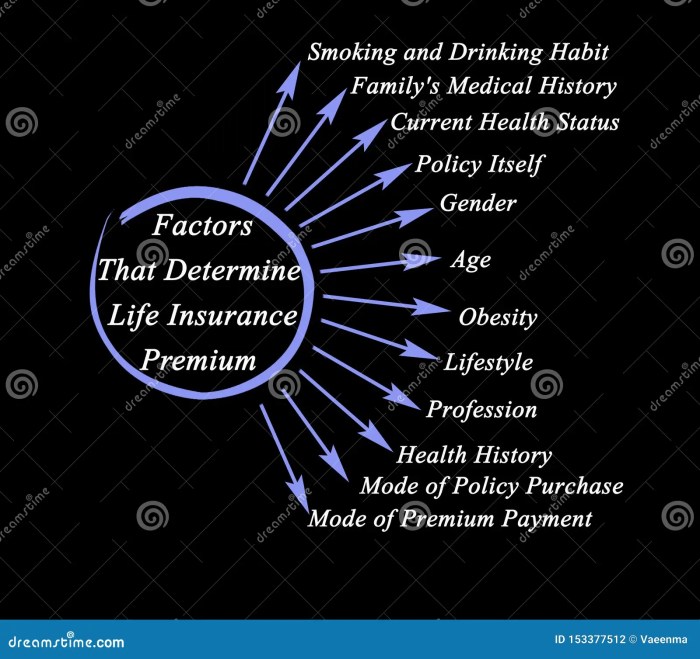

Underwriting Process

When it comes to determining life insurance quotes, the underwriting process plays a crucial role. This process involves assessing the level of risk an individual poses to the insurance company, which ultimately impacts the premiums they will pay for coverage.

Role of Underwriting

- Underwriters evaluate various factors such as age, health history, occupation, and lifestyle habits to determine the likelihood of a policyholder making a claim.

- Based on this assessment, underwriters assign a risk classification that influences the cost of life insurance premiums.

- Those deemed to be higher risk may face higher premiums or even potential denial of coverage.

Medical Exams and Life Insurance Premiums

- Medical exams are often required during the underwriting process to assess an individual's overall health and identify any pre-existing conditions.

- Results from these exams can significantly impact life insurance premiums, with healthier individuals typically qualifying for lower rates.

- Conditions such as high blood pressure, diabetes, or obesity can lead to higher premiums due to increased health risks.

Lifestyle Assessments Impact

- Underwriters also consider lifestyle factors like smoking, alcohol consumption, and participation in high-risk activities when determining life insurance rates.

- Individuals with risky habits may face higher premiums to account for the increased likelihood of premature death.

- Engaging in activities like skydiving, rock climbing, or racing can lead to higher insurance costs.

Factors Considered in Underwriting

- Age

- Health history

- Occupation

- Lifestyle habits

- Family medical history

- Driving record

- Amount of coverage desired

Geographic Location

Geographic location plays a significant role in determining life insurance quotes. Insurers consider various factors related to the insured's location when calculating premiums. Let's delve into how different aspects of geography can impact life insurance rates.

Crime Rates Impact

Crime rates in a specific area can have a direct influence on life insurance premiums. High crime areas are associated with increased risks for insurers due to the likelihood of claims being filed. As a result, individuals residing in regions with elevated crime rates may face higher life insurance costs to mitigate this risk.

Natural Disaster Risk

The risk of natural disasters in a particular region also affects life insurance costs. Areas prone to hurricanes, earthquakes, floods, or wildfires are considered high-risk zones. Insurers factor in the likelihood of these disasters occurring when determining premiums. Therefore, individuals living in regions with higher natural disaster risks may see higher life insurance quotes to offset potential claims related to such events.

Local Regulations Influence

Local regulations and laws can impact life insurance rates as well. Some regions have specific requirements or restrictions that insurers must adhere to when setting premiums. For example, certain states may have regulations that limit how much insurers can charge for coverage or dictate the types of policies that must be offered.

These regulations can lead to variations in life insurance costs based on the insured's location.

Ending Remarks

Understanding the various factors that sway your life insurance quote is crucial in making informed decisions about your coverage. By recognizing the significance of age, health, lifestyle, and occupation in shaping your premiums, you can navigate the insurance landscape more effectively.

Whether you are seeking term life insurance or whole life coverage, being aware of these influential elements can help you secure a policy that aligns with your financial goals and protection needs.

FAQ Corner

How does age influence life insurance quotes?

Age is a significant factor in determining life insurance premiums, as younger individuals typically receive lower quotes due to their lower perceived risk of mortality. As you grow older, premiums tend to increase to reflect the higher likelihood of health issues and mortality.

What impact do lifestyle choices have on life insurance rates?

Lifestyle choices such as smoking, excessive drinking, or engaging in high-risk activities can lead to higher insurance rates, as they increase the risk of premature death or health complications. Adopting healthy habits can potentially lower your premiums.

How does the coverage amount selected affect life insurance quotes?

Choosing a higher coverage amount will result in higher premiums, as the insurer is committing to a larger payout in case of your death. Lower coverage amounts typically translate to more affordable quotes.

What role does underwriting play in determining life insurance quotes?

Underwriting involves assessing your risk profile based on various factors like health, lifestyle, and occupation to determine your insurance quote. Insurers use this information to calculate the likelihood of a claim and set appropriate premiums.