Delving into Term vs Whole Life Insurance Quotes: Which Is Better for You?, this introduction immerses readers in a unique and compelling narrative, with casual formal language style that is both engaging and thought-provoking from the very first sentence.

The second paragraph provides descriptive and clear information about the topic.

Understanding Term Life Insurance

Term life insurance is a type of life insurance that provides coverage for a specific period of time, known as the term. If the insured individual passes away during the term, the policy pays out a death benefit to the beneficiaries.

Key Features of Term Life Insurance

- Term length options typically range from 5 to 30 years, providing flexibility based on individual needs.

- Premiums are generally lower compared to whole life insurance, making it a more affordable option.

- Simple and straightforward coverage without cash value accumulation or investment components.

- Death benefit is paid out to beneficiaries tax-free in most cases.

Benefits of Term Life Insurance

- Cost-effective option for obtaining high coverage amounts for a specific period.

- Flexibility to match the term length with financial obligations like mortgages or children's education.

- Ability to convert to permanent life insurance if needed in the future.

- Provides peace of mind knowing loved ones are financially protected in the event of the insured's death.

Exploring Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entirety of the policyholder's life. Unlike term life insurance, which covers a specific period, whole life insurance offers a death benefit and a cash value component that grows over time.

Advantages of Whole Life Insurance

- Guaranteed death benefit: The policyholder's beneficiaries will receive a payout upon the insured individual's death, providing financial security.

- Cash value accumulation: The cash value component grows tax-deferred over time, serving as a savings vehicle that can be accessed through loans or withdrawals.

- Lifetime coverage: Whole life insurance remains in force as long as premiums are paid, offering peace of mind that loved ones will be protected regardless of when the insured passes away.

Disadvantages of Whole Life Insurance

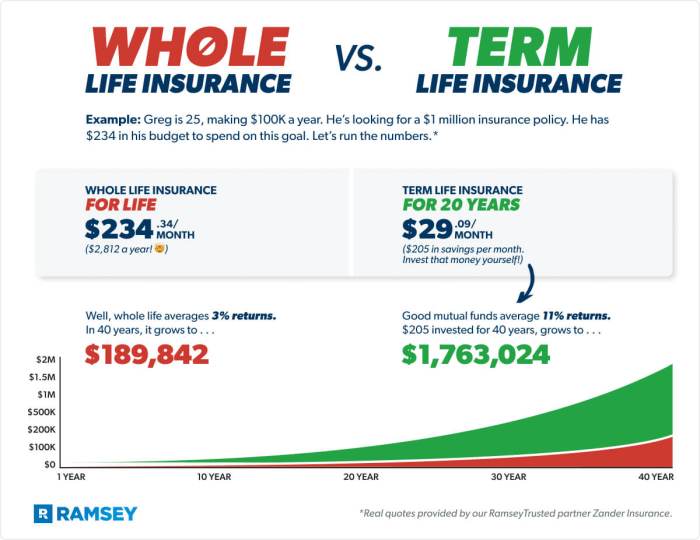

- Higher premiums: Whole life insurance typically has higher premiums compared to term life insurance, making it more expensive for individuals seeking basic coverage.

- Complexity: The cash value component and various policy features can make whole life insurance more complicated to understand than term life insurance.

- Opportunity cost: The returns on the cash value may not always outperform other investment options, leading to potential missed opportunities for growth.

Scenarios where Whole Life Insurance is Beneficial

- Estate planning: Whole life insurance can be used to cover estate taxes or provide an inheritance for beneficiaries.

- Long-term financial planning: Individuals looking for a permanent financial safety net may benefit from the lifelong coverage and cash value accumulation of whole life insurance.

- Final expenses: Whole life insurance can help cover funeral costs and other end-of-life expenses, relieving financial burdens on loved ones.

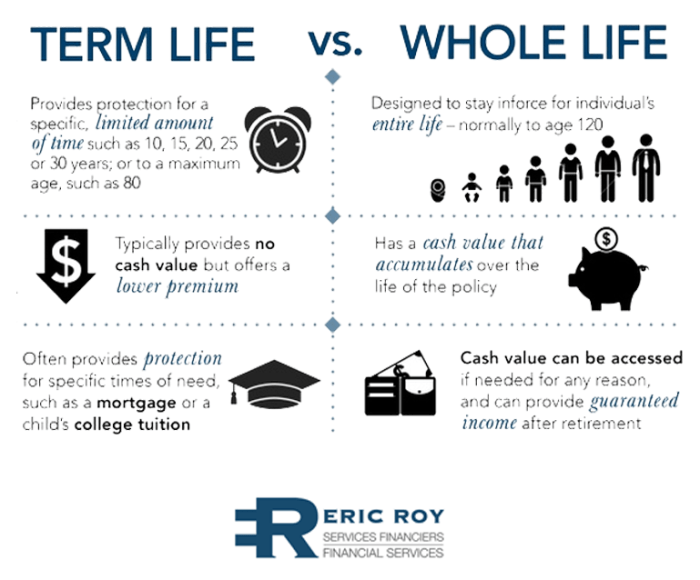

Differences Between Term and Whole Life Insurance

When comparing term and whole life insurance, it's essential to understand the key differences in premiums, coverage, duration, and flexibility each type of insurance offers.

Premiums, Coverage, and Duration

- Term life insurance typically has lower premiums compared to whole life insurance. This is because term insurance provides coverage for a specific period, usually 10, 20, or 30 years.

- Whole life insurance, on the other hand, offers coverage for the entire lifetime of the insured. The premiums for whole life insurance are higher due to the lifelong coverage and the cash value component.

- While term life insurance is more affordable initially, the premiums may increase when the policy is renewed after the term expires. In contrast, whole life insurance premiums remain consistent throughout the policyholder's life.

- Term life insurance provides pure death benefit protection, while whole life insurance combines a death benefit with a cash value component that grows over time.

Flexibility in Customization and Adjustments

- Term life insurance offers limited flexibility as it is designed for a specific term with a set premium and coverage amount. Policyholders can usually renew or convert their term policy, but customization options are minimal.

- Whole life insurance provides more flexibility and customization options. Policyholders can adjust their coverage amount, premium payment schedule, and even access the cash value through policy loans or withdrawals. Whole life policies also offer potential dividends depending on the insurer's financial performance.

- Whole life insurance is considered a long-term financial planning tool due to its cash value accumulation and the ability to borrow against the policy. This can provide additional financial security and flexibility for policyholders.

Factors to Consider When Choosing Between Term and Whole Life Insurance

When deciding between term and whole life insurance, there are several factors individuals should consider to make an informed choice. Financial goals, age, and health play a crucial role in determining which type of insurance is most suitable for each individual.

Evaluating personal needs is essential to ensure the chosen insurance aligns with the individual's specific circumstances.

Financial Goals

- Consider your long-term financial objectives and how insurance fits into your overall financial plan.

- Assess your budget and determine how much you can afford to allocate towards insurance premiums.

- Evaluate whether you prioritize lower premiums with term insurance or the cash value accumulation of whole life insurance.

Age

- Your age can impact the cost of insurance, with younger individuals generally paying lower premiums for both term and whole life policies.

- Consider how long you need coverage for and whether term insurance aligns with your coverage needs at different stages of life.

- For whole life insurance, younger individuals have more time to benefit from cash value accumulation and potential dividends.

Health

- Your health status can influence the cost of insurance and the availability of coverage options.

- Individuals with pre-existing medical conditions may find it challenging to qualify for certain types of insurance.

- Consider whether you require medical underwriting for whole life insurance or prefer the simplicity of term insurance without extensive health evaluations.

Evaluating Personal Needs

- Assess your short-term and long-term insurance needs based on your financial obligations and dependents.

- Determine whether you prioritize affordability, flexibility, or cash value accumulation in your insurance policy.

- Consult with a financial advisor to evaluate your overall financial situation and receive personalized recommendations based on your specific needs.

Final Review

The concluding paragraph provides a summary and final thoughts in an engaging manner.

Essential FAQs

What are the key features of term life insurance?

Term life insurance provides coverage for a specific period, usually at a lower cost compared to whole life insurance. It does not build cash value.

What are the advantages of whole life insurance?

Whole life insurance offers lifelong coverage, builds cash value over time, and has fixed premiums.

How do term and whole life insurance differ in premiums?

Term life insurance generally has lower premiums initially compared to whole life insurance, which can be more expensive but offers additional benefits.

How does age influence the choice between term and whole life insurance?

Younger individuals may find term life insurance more cost-effective, while older individuals might benefit more from whole life insurance due to its lifelong coverage.

What factors should be considered when choosing between term and whole life insurance?

Factors such as financial goals, age, health, and coverage needs should all be taken into account to make an informed decision.