Embark on a journey to discover the ease and convenience of obtaining instant life insurance quotes online. This guide will walk you through the process, benefits, and factors to consider, ensuring you make informed decisions about your coverage.

How to Get an Instant Life Insurance Quote Online

When you're in the market for life insurance, getting an instant quote online can save you time and hassle. Here's a breakdown of how to obtain an instant life insurance quote online.

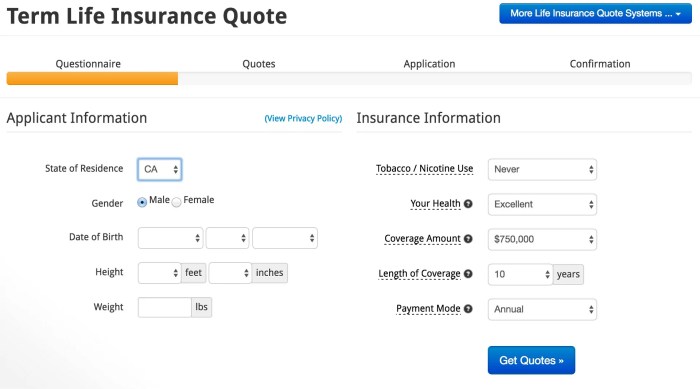

Step-by-Step Guide to Getting an Instant Quote Online

- Visit the website of a reputable life insurance provider that offers online quotes.

- Locate the section on the website that allows you to input your information for a quote.

- Fill in the required details such as your age, gender, smoking status, desired coverage amount, and term length.

- Submit the information and wait for the website to generate your instant life insurance quote.

Information Required for an Instant Life Insurance Quote Online

- Your age: Younger individuals typically receive lower quotes.

- Gender: Rates may differ between males and females.

- Smoking status: Smokers generally pay higher premiums.

- Coverage amount: The higher the coverage, the higher the premium.

- Term length: Longer terms may result in higher premiums.

Advantages of Getting an Instant Quote Online

- Convenience: Obtain quotes from the comfort of your home without the need for in-person meetings.

- Speed: Instant quotes provide quick access to pricing information.

- Comparison: Easily compare quotes from different providers to find the best deal.

- No pressure: Online quotes allow you to review and consider options at your own pace.

Benefits of Instant Life Insurance Quotes Online

Online platforms offer several key benefits when obtaining life insurance quotes. One of the primary advantages is the convenience and speed of receiving instant quotes, saving valuable time for individuals seeking life insurance coverage. This allows for a quick comparison of different quotes from various insurers, helping individuals make informed decisions about their life insurance needs.

Time-Saving Process

Receiving instant life insurance quotes online eliminates the need for lengthy phone calls or in-person meetings with insurance agents

Convenience of Instant Quotes

The convenience of obtaining instant life insurance quotes online cannot be overstated. Individuals can easily access quotes at any time of the day, from the comfort of their own home or office, without the need to schedule appointments or wait for callbacks.

This convenience empowers individuals to take control of their life insurance decision-making process.

Informed Decision-Making

By providing instant access to multiple quotes, online platforms enable individuals to make well-informed decisions about their life insurance coverage. The ability to compare different quotes side by side allows individuals to assess various coverage options, premiums, and policy features, ensuring they choose a policy that meets their specific needs and budget requirements.

Factors to Consider When Getting an Instant Life Insurance Quote Online

When obtaining instant life insurance quotes online, there are several crucial factors individuals should consider to ensure they receive accurate and relevant information tailored to their needs. Personal details such as age, health status, and coverage requirements play a significant role in determining the cost and coverage options available.

Impact of Personal Details on Online Quotes

- Age: Younger individuals typically receive lower premium quotes as they are considered lower risk. Older individuals may face higher premiums due to increased health risks.

- Health: Individuals in good health are likely to receive more affordable quotes, while those with pre-existing conditions may face higher premiums or limited coverage options.

- Coverage Needs: The amount of coverage required and the duration of the policy can impact the quotes provided. Higher coverage amounts and longer policy terms often result in higher premiums.

Types of Life Insurance Policies and Quoting Process

- Term Life Insurance: Offers coverage for a specific period at a fixed rate. Quotes for term life insurance are generally more affordable compared to other types of policies.

- Whole Life Insurance: Provides coverage for the entire lifetime of the insured. Premiums for whole life insurance are typically higher but offer additional benefits such as cash value accumulation.

- Universal Life Insurance: Offers flexibility in premium payments and coverage amounts. Quotes for universal life insurance can vary based on the chosen investment options.

Tips for Accurate Information Input

- Provide truthful and up-to-date personal information to receive the most precise quotes.

- Double-check all details entered, including health history and coverage preferences, to avoid discrepancies in the quotes provided.

- Compare quotes from multiple insurers to ensure you are getting the best coverage at a competitive price.

Closing Summary

In conclusion, getting an instant life insurance quote online presents a modern solution that saves time and provides valuable insights for individuals looking to secure their future. With just a few clicks, you can access the information you need to make the right choices for your life insurance needs.

Common Queries

What information is typically required to get an instant life insurance quote online?

Usually, you'll need to provide details such as age, health status, coverage amount, and possibly lifestyle habits.

How do online quotes differ from traditional methods of obtaining life insurance quotes?

Online quotes offer convenience, speed, and the ability to compare multiple options easily, whereas traditional methods may take longer and involve more paperwork.