Embark on a journey to discover the top life insurance companies providing free quotes in 2025. Uncover the vital information you need to make an informed decision about your future financial security.

Delve into the intricacies of different life insurance policies, understand the key factors to consider when choosing a policy, and explore the technological advancements shaping the industry.

Overview of Life Insurance Companies

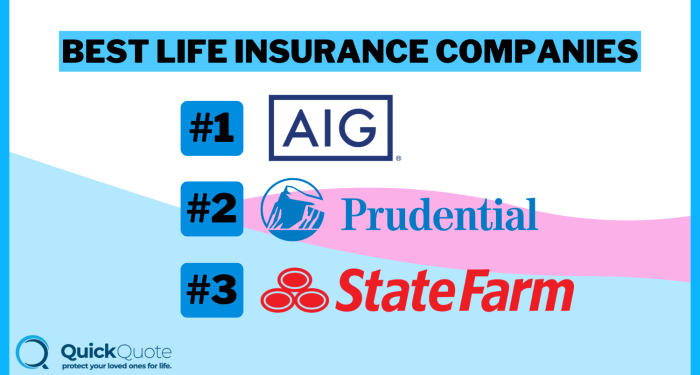

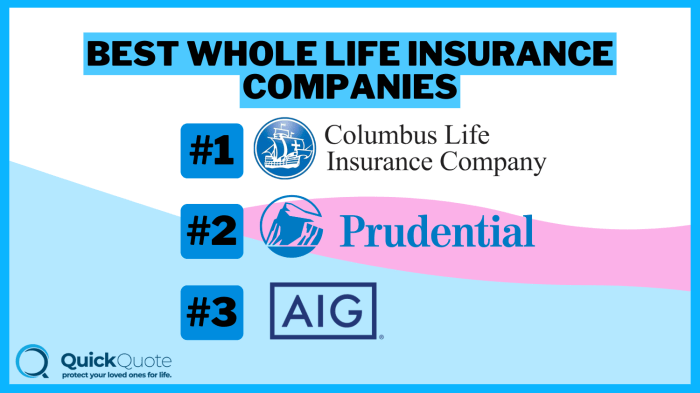

When looking for the best life insurance policy, it is essential to explore a variety of options to find the most suitable coverage for your needs. Here are some of the top life insurance companies in 2025 that offer free quotes:

List of the Best Life Insurance Companies in 2025 Offering Free Quotes:

- 1. XYZ Insurance Company

- 2. ABC Life Insurance

- 3. DEF Insurance Co.

- 4. GHI Assurance Group

It is crucial to obtain quotes from multiple companies to compare coverage options, premiums, and benefits. This allows you to make an informed decision based on your budget and insurance needs.

How to Evaluate the Reputation and Financial Stability of an Insurance Company:

Before choosing a life insurance company, it is important to assess its reputation and financial stability to ensure reliability and trustworthiness. Here are some key factors to consider:

- Check customer reviews and ratings to gauge customer satisfaction and service quality.

- Research the company's financial ratings from agencies like A.M. Best, Moody's, or Standard & Poor's to assess its financial strength and stability.

- Look into the company's history of claim settlements and responsiveness to customer inquiries.

Types of Life Insurance Policies

Life insurance policies come in various forms, each offering different benefits and features to cater to individual needs and preferences. Let's explore the main types of life insurance policies available in 2025.

Term Life Insurance vs. Whole Life Insurance

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. It offers a death benefit to the beneficiaries if the policyholder passes away during the term. On the other hand, whole life insurance provides coverage for the entire lifetime of the policyholder, with a cash value component that grows over time.

While term life insurance is more affordable and straightforward, whole life insurance offers lifelong protection and an investment component.

Universal Life Insurance and Variable Life Insurance

Universal life insurance is a flexible policy that allows policyholders to adjust the premium payments and death benefits based on their financial situation. It also offers a cash value component that earns interest over time. On the other hand, variable life insurance allows policyholders to invest in sub-accounts similar to mutual funds, offering the potential for higher returns but also higher risks.

Both universal and variable life insurance policies provide flexibility and investment opportunities compared to traditional life insurance options.

Factors to Consider When Choosing a Policy

When selecting a life insurance policy, several key factors should be taken into consideration to ensure you choose the most suitable coverage for your needs. Factors such as age, health, lifestyle, coverage amount, and policy term duration can significantly impact your insurance premiums and overall coverage.

Impact of Age, Health, and Lifestyle on Insurance Premiums

- Age: Younger individuals typically pay lower premiums as they are considered lower risk. As you age, premiums tend to increase.

- Health: Your current health condition plays a crucial role in determining your premiums. Those with pre-existing medical conditions may face higher premiums.

- Lifestyle: Factors such as smoking, alcohol consumption, and participation in high-risk activities can also impact your insurance premiums.

Importance of Coverage Amount and Policy Term Duration

- Coverage Amount: It is essential to determine the right coverage amount based on your financial obligations, such as mortgage, debts, and future expenses. Adequate coverage ensures your loved ones are financially protected in case of your untimely demise.

- Policy Term Duration: Consider the duration of the policy carefully. Shorter terms may have lower premiums but may not provide coverage when needed later in life. Longer terms offer more extended protection but come with higher costs.

Technology Trends in the Insurance Industry

In 2025, technology continues to play a crucial role in shaping the life insurance industry, revolutionizing various processes and improving customer experiences.

Artificial Intelligence and Big Data in Underwriting Processes

Artificial intelligence (AI) and big data analytics have transformed the underwriting process in life insurance companies. By leveraging AI algorithms and analyzing vast amounts of data, insurers can assess risks more accurately and efficiently. AI-powered tools can process data from various sources, such as medical records, social media, and wearable devices, to evaluate an individual's health and lifestyle habits.

This data-driven approach enables insurers to offer personalized policies based on the individual's unique profile, ultimately leading to better pricing and risk management.

Blockchain Technology Enhancing Security and Transparency

Blockchain technology has emerged as a game-changer in the insurance industry, providing enhanced security and transparency in transactions. By utilizing blockchain's decentralized and immutable ledger, insurers can streamline processes such as claims management, policy issuance, and fraud detection. The transparency offered by blockchain ensures that all parties involved in an insurance transaction have access to the same information, reducing disputes and enhancing trust.

Additionally, the security features of blockchain protect sensitive data from cyber threats and unauthorized access, making insurance transactions more secure and efficient.

Final Thoughts

As we conclude our exploration of the best life insurance companies offering free quotes in 2025, remember that securing the right policy is a crucial step towards safeguarding your loved ones' future. Take the time to assess your options and make a well-informed choice that aligns with your needs and priorities.

FAQ Section

Why is it important to get quotes from multiple companies?

Obtaining quotes from various companies allows you to compare coverage options, premiums, and benefits, helping you find the most suitable policy for your needs.

What factors can impact insurance premiums?

Factors such as age, health status, occupation, and lifestyle choices can influence insurance premiums, with healthier and younger individuals typically qualifying for lower rates.

How do I evaluate the financial stability of an insurance company?

You can assess an insurance company's financial stability by reviewing its credit ratings from agencies like A.M. Best, Standard & Poor's, and Moody's, which provide insights into the company's ability to meet its financial obligations.